We Boggart Bloggers have written extensively about the efforts of China and Russia to either float a new global reserve currency, backed by gold, to replace the US$ or at least serve as a rival and an alternative to the dollar. Now, post pandemic, post Great reset, and with war in Ukraine still threatening to plunge the world into its biggest economic crisis ever. The signs were there ten years ago, but now we see it happening. Saudi Arabia has effectively killed the petrodollar by agreeing with China, the world's biggest importer of oil and petroleum products, to accept payment for Saudi oil in Chinese yuan.

For more history on the dedollarization of world trad go to out Currency Wars page.

For a summary of how things stand now read the embedded article below.

In 2017 while researching option marketmaking business ideas in Energy overseas, much was learned about the growing rift between the BRICS and the G7 as it manifested even back then.

Making Markets in NYMEX Oil and Natural Gas Options...

One byproduct of this explorative experience was seeing1 how global commodity supply/demand pricing dynamics could handicap global trade trends.Regarding Gold, this is what we learned back then:

Since 2013 global players in Gold (and Oil) had been slowly opening up shop in the East and closing it in the West. Demand had been moving eastward, and related businesses followed that demand.

Over some years, a slow but unmistakable drift from the US to China was observed in Gold businesses. Between 2013 and 2017, gold demand in Asia caused a great migration eastward of vaults, physical and financial trading operations, and finally exchanges themselves to open shop there. Why? Because that is where the demand was.

What was also learned and observed was a growing but inextricable tie forming between Oil, Gold, and the Chinese Yuan. That learning gelled during a conversation between a physical oil trader and this author.

The physical oil trader (paraphrased) said this in 2017:

A few months ago, Russia did some Oil deals with China amounting to about $3BB testing Blockchain connectivity. The deals somehow were done through Seychelles and called for settlement in Yuan with a kind-of embedded call [EDIT- his words not mine-VBL] to convert to Gold on demand. So basically Russia and China did a Gold-for-Oil trade and used Blockchain to verify the Gold in Shanghai for custodial chain purposes.

We had been discussing blockchain potential in Oil and Gold clearing trades. But, long story short, the whole mechanism for Gold remonetization worldwide was witnessed in a single mind-blowing moment. Since then this author has written and spoken (NY Mines and Money) on the obsession many times to anyone in earshot.

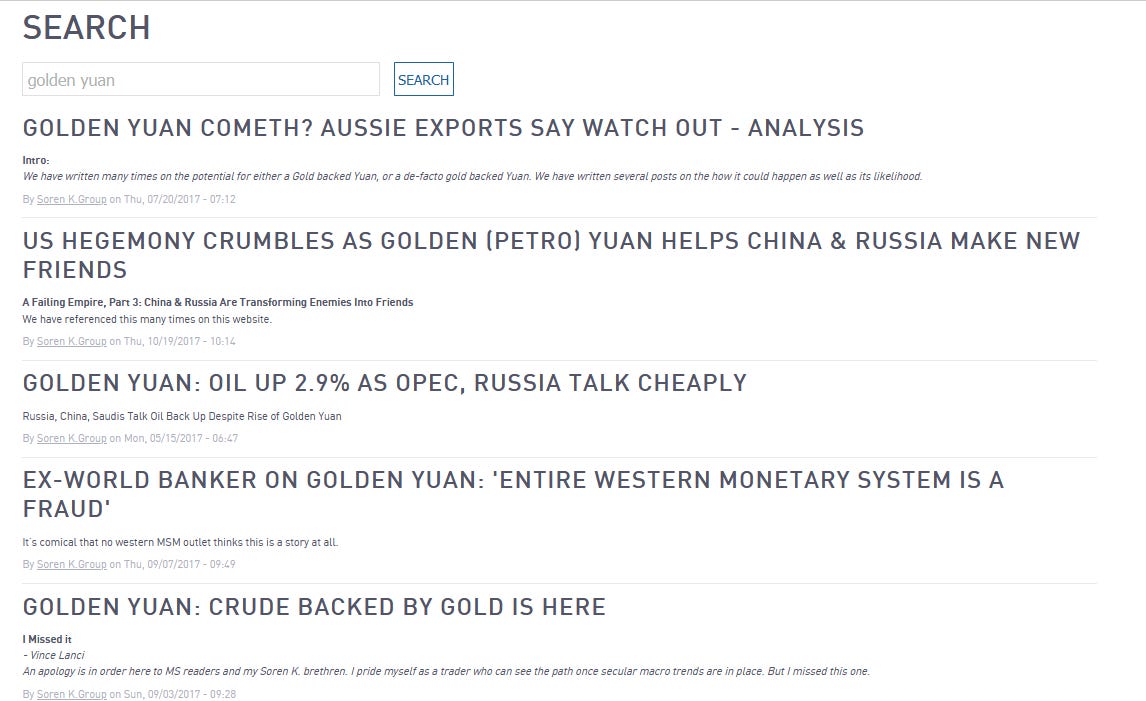

Golden Yuan 2017 Articles…

What I saw as a test of Blockchain between Russia and China was much further along than originally seen.Deals are being done… And the info I got was that the gold paid to Russia never left the Chinese vault.

Source: Golden Yuan: Crude Backed By Gold is Here

EXPLORE:

[Daily Stirrer] ... [ Our Page on on Substack ]... [Boggart Aboad] ... [ Ian Thorpe at Quora ] ... [ Greenteeth Home ] ... [ Greenteeth on Minds.com ] ... [ Here Come The Russians ] ... [ Latest Posts ] ... [ Blog Bulletin ]