In spite of our resident money and finance expert, along with myself and other contributors regularly being described as anti - American clowns, employees of Vladimir Putin or Xi Jinping, Nazis, capitalist scum and a some rather more colourful things when we write about currency wars and the decline of the US$ as China, Russia, Iran and other emerging economies plot and conspire to replace the US$ as global reserve currency, de - dollarisation is a fact. From Brazil to Saudi Arabia, and from India to Argentina, and increasing number of nations are 'reportedly' shifting away from the dollar hegemon.

The Dollar Index (or any other index tracking movements in the currency market) reveals an underlying trend. Year on year for the past decade the dollar's share of world trade is declining. This is a relative measure of course, US pseudo - patriots will be able to point to increases in the total amount of trade done in dollars, it's true. But the global economy is growing too, and the amount of trade done in dollars as a proportion of all international trade is steadily declining.

Picture: Zero Hedge

The dollar's fecal emissions are some way from hitting any rapidly rotating wind turbine yet, but Stephen Jen, a currency trading guru who now runs money at Eurizon SLJ, recently speelled out exactly how rapidly the de-dollarization is ocurring.

Jen, warned in a recent briefing, that the dollar is losing its reserve status at a faster pace than generally accepted, as many analysts have failed to account for last year’s frantic swings in exchange rates.

“The dollar suffered a stunning collapse in 2022 in its market share as a reserve currency, presumably due to its muscular use of sanctions,” Jen and his colleague Joana Freire wrote.

“Exceptional actions taken by the US and its allies against Russia have startled large reserve-holding countries,” most of which are emerging economies from the so-called Global South, they said.

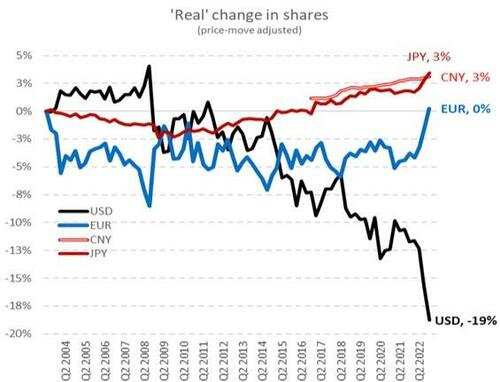

As this FT infographic illustrates, if you adjust for price changes the dollar’s share of official global reserve currencies (values of a currency held by foreign governments,) has gone from about 73 per cent in 2001 to around 55 per cent in 2021.

Then, last year, it fell to 47 percent of total global reserves.

Source: Eurizon SLJ Capital

More ominously, the USD is losing its market share as a reserve currency at a much faster rate than is commonly believed.

"After steady declines in its global market share for the past two decades, in 2022 the dollar lost market share at a pace 10 times as rapidly. Analysts have failed to detect this big change because they calculate the nominal value of the world’s central banks’ dollar holdings without considering the changes in the price of the dollar. Adjusting for these price changes, the dollar, we calculate, has lost some 11 percent of its market share since 2016 and double that amount since 2008.

This erosion in the USD’s reserve currency status has accelerated precipitously since the start of the war in Ukraine. Exceptional actions taken by the US and its allies against Russia have startled large reserve-holding countries, most of which are from the Global South.

...Without the need for us to take sides in this debate on Ukraine, it seems reasonable to speculate that the main driver of the collapse in USD’s reserve status in 2022 may have reflected a panicked reaction to property rights being jeopardised. What we witnessed in 2022 was sort of a ‘defund-the-global-police’ moment, whereby many reserve managers in the world disagreed with the conduct of both Russia and the US."

To put it bluntly the greenback’s share in global reserves slid last year at 10 times the average speed of the past two decades as a number of countries looked for alternatives after Russia’s invasion of Ukraine triggered sanctions.

As any economist or corporate CFO will tell you there are two pillars that maintain the US dollar in is dominant position and thus prop up the entire American economy: its role as the reserve currency of choice, and its dominant

use in global finance and trade. Investors far too often confuse these two different concepts.

Stephen Jen argues. "While the Global South seems unwilling to continue to hold dollar assets, they have lacked the ability to divest from the US dollar as an international currency, particularly for financial transactions."

While it will be very difficult to overcome the strong network effects that have been behind the dollar’s international currency status, the bid led by China, Russia and Iran, now joined by Saudi Arabia, India and Brazil loks strong enough to be capable of doing just that.The key to topple the dollar’s throne as an international currency is predicated on the relative developments and stability in the various financial markets, but with China Russia and Iran having recently cooperated in launching the Petroyuan and announced plans for a gold backed reserve currency to rival the dollar the outlook is bleak for the world's more powerful economy and in the light of internal divisions and the loonytoons policies of the current government it is only likely to become bleaker.

RELATED:

De - Dollarisation: China, Brazil Make Deal To Ditch US Dollar For Bilateral Trades

China and Brazil this week concluded a deal to conduct trade between their nations in their own in their own currencies, ditching the established reserve currency for global trade, US dollar as an intermediary, the Brazilian announced said on Wednesday. This is Beijing’s latest strike against the almighty greenback in its currency war aimed at shifting the balance of geopolitical and economic power from west to east.

NATO Rhetoric About Russian Threat is 'Absurd'

The reasons being given for the latest NATO military buildup in Eastern Europe, the idea that the Russian 'Russian threat' to Eastern Europe grows every day is "simply absurd," according to former US diplomat and Senate policy advisor Jim Jatras. Effectively, Jatras says, the buildup is an attempt by the US to keep Germany and France on board with Washington's world domination agenda and ...

Naked Bankers Go For Gold

... That gold sale in 2013 was a naked short. The seller had no gold to sell. COMEX reported having gold only equal to about half of the short sale in its vaults, and not all of that was available for delivery (quite a lot of it belonged to the german government) In effect the naked shorting of gold could only work because really the right hand was selling to the left hand.

The Demise Of Dollar Hegemony: Russia Breaks Wall Streets's Oil-Price Monopoly In a move that went almost completely unreported in mainstream media, Russia has recently opened a market for the trading of physical and 'paper' oil (futures) in Moscow in Roubles. This is the most blatant challenge yet to the domination of the US dollar in world trade.

WMD in Mayfair

Recalling yesterday's Machiavelli Blog which commented on events surrounding the unfortunate death of the alleged former Russian agent Alexander Litvinenko, it seems the murder investigation has now found evidence of many caches (well OK, traces) of radio active toxins in various fashionable establishments in London's West End frequented by former Russian intelligence agents.

China launches global yuan payment system

China’s Central Bank has started a global payment system which provides cross-border transactions in yuan. The China International Payment System (CIPS) intends to internationalize the yuan and challenge the US dollar's dominance.

Refugee Crisis Or Existential Battle With USA for Europe

It has been clear for some years now that the USA, backed by its main NATO and EU military allies the UK and France (the FUKUS axis has been trying to provoke Russian into firing the shot that will be heard around the world and recognised as the startiung signal for World War Three.

Nothing is ever as it seems to be however, and views from middle east and far eastern journals suggest the USA is also working at destabilizing EU nations in order to force their support in its wars.

The European People’s Party (EPP) is the largest political group in the European Parliament, and they are unerringly supportive of America's efforts to start a war with Russia. “The time of talk and persuasion with Russia is over," MEP and Vice-President of the EPP told a meeting on Tuesday, 21 April, “Now it’s time for a tough policy, and concentration on defence and security ...”

The Mediterranean Boat People Crisis - How Does Europe Deal With The Mediterranean Migrant Crisis

The numbers of migrants trying to cross from the Libya on the coast of north Africa to one of the EU's southern nations is increasing. Europe's impoverished southern nations can't cope. And in the better off nations of northern Europe immigration is a toxic issue which is fuelling the rise of anti EU parties from France to Finnland in the north and Hungary in the east. What can be done?

This Is Why The US Just Lost Its Superpower Status According To Larry Summers

As more and more countries flock to join the Chinese led Asian Infrastructure Investment Bank after Britain, France Australia, India and other traditional US allies defied Washington to associate themselves with China's initiative, conservative economic pundit Larry Summers once a contender for the chairmanship of the Federal Reserve delivered a sharp rebuke ...

The True Debt Disaster America Faces - Only A Fraction Of Government Debt Is Known To The Public

Politicians and the media talk about the $17 trillion debt the US Government owes to creditors. They are lying, the $17 trillion is a fraction of what america owes. The real figure is $200 trillon. And Obama's loonytoons economics are driving that up at an accelerating rate.

U.S. versus Russia War: Top Russian Politics Scolar Stephen Cohen Tells The Truth

We have been blogging for four years about the US drive for war, provocation of Russia in Syria, Iraq, Ukraine and elsewhere made it obvious. But I'm just a news junkie with a strong sense of curiosity and have wondered why the US seems set on this course. Good to see experts like Stephen Cohen, a prominent expert on, Russia are coming onside.

Does It matter If The Dollar Is Replaced?

"Without delving too deeply into Austrian economic and capital theory, just let me point out that money printing disrupts the structure of production by fraudulently changing the “price discovery process” of capitalism. Capital is allocated to projects that will never be profitably completed. Bubbles get created and collapse and businesses are suddenly damaged en mass, thus, destroying wealth. (Zero Hedge)"

What the BRICS plus Germany are really up to in the Currency Wars?

The move led by Russia and China to dump the Petrodollar has escalated into a currency war, not the kind of war we assciate Obama with but give him time. Some wars as in Ukraine, by proxy are not going so well. Others, like the one against Islamic State aka ISIS aka ISIL in the middle east are going worse. Disintegration of The American Economic Empire is manifesting itself in moves by wannabe global players towards creating a multipolar world ...

No comments:

Post a Comment