By John Kemp, Senior Market Analyst at Reuters

EU leaders have stepped back from imposing an immediate embargo on Russian crude and petroleum product imports as the impracticality of the policy has become clear. Imposing an immediate embargo on Russia’s fossil fuels “from one day to the next would mean plunging our country and the whole of Europe into a recession,” Chancellor Olaf Scholz told German lawmakers this week.

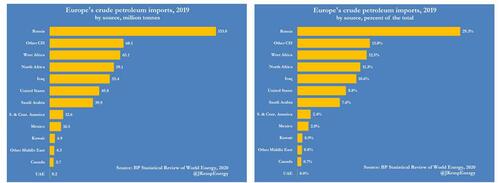

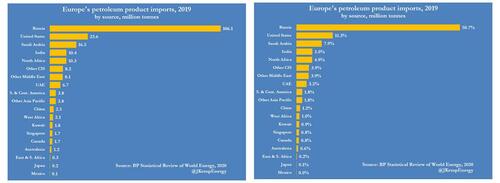

Russia’s exports of crude and petroleum products to Europe are the second largest bilateral flow of oil between any two trading partners in the world, behind the United States and Canada, according to data from BP.

Russia supplied 29% of Europe’s crude imports and 51% of the continent's petroleum product imports in 2019, the last year before the pandemic (“Statistical review of world energy”, BP, 2020).

No other trading partner came close to Russia’s share, which would make it extremely hard to replace in the short term.

So even speculation about a possible ban drove oil prices sharply higher this week, as traders weighed the practical difficulties, before prices retreated as it became clear EU policymakers were backing away from the idea.

Explore our pages:

No comments:

Post a Comment