As the shooting wars grind on in Ukrsine, Gaza, Syria, The Red Sea, Sudan and e;sewhere, the main theatre of war is now shifting from the battlefields to the financial centres of the world.

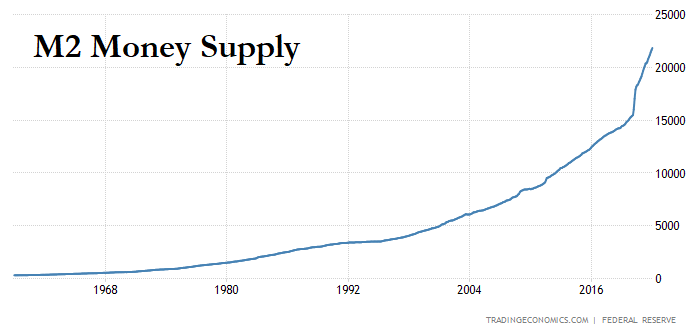

Many of you will have been reading in mainstream media about de-dollarization recently, and may have been surprised to learn of the various attempts and strategies being deploted to facilitate trade among the various countries' currencies without using the US dollar, which has been the main reserve currency for intrnational trade since World War Two. You may be even more surprised to learn that Boggart Blog and its various offshoots have been writing about de-dollarisation and currency wars for over ten years. Most international trade is still conducted in dollars, which means the buyer has to purchase dollars in order to make the settle the transaction, and that often means the sale is settled at a U.S.-controlled bank ... a situation which many nations feel Washington has exploited unfairly to preserve its global economic hegemony.

The established world order has come to the dangerous state it is curreently in, because the U.S. exerts uses its position of economic dominance via he dollar to exert political influence. To put it bluntly the U.S.A. has "weaponised" finance. Avoiding the U.S.ninvolvement in cross border transactions is complex and there's a lot of resistance to change particularly from US banks.

There are a number of new, rapidly developing tools and organizations to do this job, and more importantly there are new players with major resources and even bigger motivations that have committed themselves to make non-dollar-denominated trade easy, reliable and fast. And soon.

Russia and China, two of the nations, along with Iran, that started the move to de dollarise world trade over a decade ago are leading, their BRICs trading bloc is likely to be the first major beneficiary of the new trading tools, and now Saudi Arabia has weighed in: SA has let the "price all oil sales in dollars" deal with the U.S. lapse.

This has now been reported in the U.S. and European mainstream media press , with all the appropriate consternation over likely impacts.

M.K Bhadrakumar (IndiaPunchline.com) has a new article out that covers the waterfront - the technologies, the big players, the Saudis, and the impact on the U.S. of de-dollarization. If you're new to the subject, this is a decent place to start.

As many critics have pointed out, everyone knows _why_ other countries are motivated to de-dollarize. The question is "what's the alternative?".

Alternatives get built when the motivation, resources, and capability thresholds are met. They've been met.

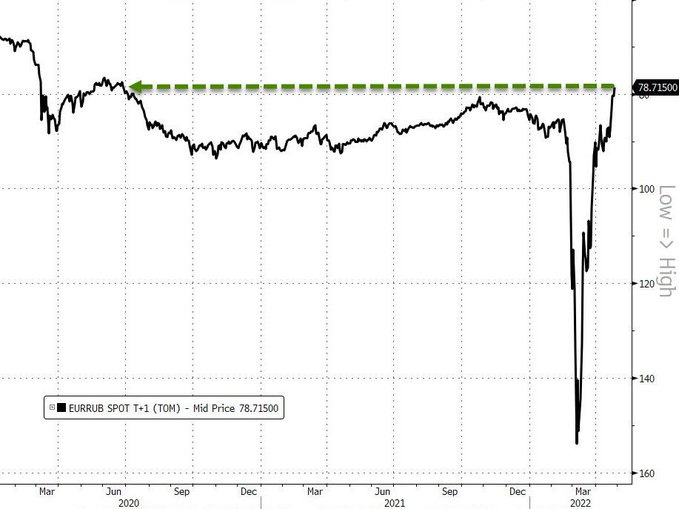

If the Saudis actually do start pricing in currencies other than dollars (remember, letting the deal lapse, and actually pricing their oil in different currencies are two separate events), and if China and Russia really do build the multi-currency trading system for BRICS, and remember they have already started the process by creating the 'petroyuan' to rival the global standard 'ptrodollar vehicle for ttrading oil futuresd, this is certin to bring to an end the "exorbitant privilege" of the U.S. as issuer or the global reserve currency.

And that will be a major, major change in the U.S.' situation.

For further reading, search "mBridge" and "BRICs". That'll provide much food for thought.

[ Currency Wars ] ... [ Culture Wars ] ... [ Middle East ] ... [ Ukraine ] ... [ free sppech murdered ] ... [ death of democracy ] ... [ New World Order ]

Will Commodities Be The New Reserve Currency As The Death Knell Of The Dollar Sounds?

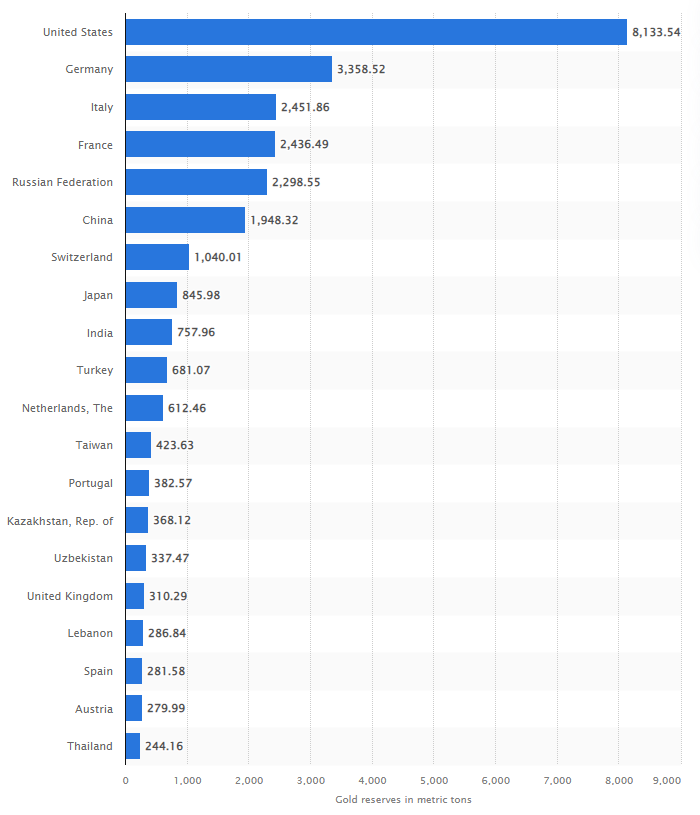

Many respected economists and market analysts who favour the free markets approach concur that we are heading towards a new economic reality that will see the collapse of the US$ as the default reserve currency, to be replaced not by any other fiat currency such as the Euro or the Renminbi, but by a system in which commodities are the

primary denominator of value. Should this turn out to be the case we can expect an acceleration of the shift in geopolitical power from west to East.

We The Good Guys Versus They The Bad Guys Reporting Does Not Make Sense For The Ukraine Crisis

Mainstream media reporting of the conflict in Ukraine has disappointed. Perhaps I was naive to suppose that lessons might have been learned from the hits their print sales and online traffic rates took as a result of their handling the COVID pandemic But instead of focusing on the most obviously newsworthy aspect of the build up to and escalation of the war, Russia’s view of NATO expansion into Ukraine and even further to Georgia and Kazakhstan, news reports have simply demonised Russia and portrayed Ukraine as the good guys.

Europe's Depleted Gas Storage Might Not Get Refilled Ahead Of Next Winter

While mainstream news reporting of the conflict in Ukraine continues to pump out a torrent of anri - Russia, pro - war propaganda the catastropic effects of this war that could so easily have been avoided are not mentioned. Well why would warmongering governments admit they have inflicted an energy crisis, food shortages and soaring living costs on their people for no good reason ...

Russia Just Sent out a Message NATO Should Better Listen To

The key paragraph from the latest official Russian naval doctrine is that Putin and his military advisers have sent a clear message that NATO encroachment is unacceptable. To be honest, there is nothing earth shattering in this, The Daily Stirrer and many other alternative media news and analysis sites have been warning for about two years that Obama's foreign policy was making conflict inevitable. De - dollarization Moves Ahead - Once Again We Told You So,

What Putin Wants

China Warns U.S. to Stop Its Ukrainian Proxy War Against Russia

The World Rejects USA Attempt To Manipulate Venezuela

India's Ruling BJP Party Crushed In Regional Poll

Another Conspiracy Theory Becomes Fact: Oil Collapse Is All About Obama's Proxy War With Russia.

G77 Nations vow to destroy petrodollar and America’s New World Order

American Dollar Dumped

Iran's Oil and the US Dollar

Money From Rock Better Than Money From Air

There Is Only One Way Ukraine Can End The War

As Ukraine's much hyped counterattack has failed to achieved the and momentum that hoped for by American and NATO leaders including President Volodymyr Zelensky who admitted it was "slower than desired", and a range of soldiers interviewed by BBC and Sky News television reporters t on different parts of the long (probably too long given the depletion of Ukrainian military manpower,) frontline have blamed minefields laid by Russian troops for that delay. Well as is often said, in any wartruth is the first casualty.

Gigantic Nova Kakhova Dam in Ukraine Blown Up - Each Side Blames The Other As The War Grinds On

A day after Ukraine's much-heralded counter-offensive appears to have failed, almost before it had even begun, a major dam in the Russian-occupied region of Kherson is suddenly bombed, prompting mass evacuations as floods spread across the region. Both sides accuse each other of the attack that puts tens of thousands of homes at risk and might even threaten the safety of Europe's largest nuclear power plant.

Washington Leaks Show Ukraine Has Lost The War (And Expose The Dishonesty Of Western Governments And Media)

The leaked U.S. intelligence documents recently published in western mainstream media have exposed the extent to which pro - war propaganda suggesting Ukraine was winning the war is now seen to be a US & NATO led effort to weaken Russia and effect regime change. It looks more likely some western governments are facing regime change as citizens, tired of sky - high energy costs, soaring food prices, and of being lied ...

Russia Will Never Recover From War In Ukraine Claim Zelensky Fan Club As Russia Continues to Crush Ukrainian War Effort

An inside page headline in yesterday's (1 April 2023) Daily Telegraph claims 'Russia will never recover from this devastating collapse,' though the article below it does not quite make clear exactly what collapse the writer is talking about. The Telegraph has been unashamedly pro Ukraine, Zelensky worshipping and Russophobic in its coverage since day one of the war and the article was not an April Fool joke

Zelensky Admits Ukraine Already Ran Out Of Ammo

The US-led West’s Mainstream Media (MSM) began reporting more accurately on the military-strategic dynamics of the NATO-Russian proxy war in Ukraine since the start of the year, but the true test of their comparatively improved integrity will be whether they raise awareness about Zelensky’s latest damning admission. In an interview with Japanese newspaper Yomiuri Shimbun, he candidly told his interlocutors that “We do not have ammunition. For us the situation in the East is not good.”

Dollar Dominance Will Be The Biggest Casualty Of War In Ukraine

While the mainstream news cycle focuses on Ukraine and speculation about when the strategically significant city of Bakhmut, beseiged by the Russian army for months now, will actually fall, with Ukrainian defenders vowing to fight to the last man but gradually being forced into a smaller and smaller area of the city centre, in the more significant economic war Russia, China and Iran, backed by India, Saudi Arabia and many other African and South East Asian nations are pushing ahead with moved to dump the US dollar as the global reserve currency

Ukraine: Who Is Winning And Losing In The Economic War

One year ago today, to provide a legal framework for Russian military support to Donetsk and Luhansk which would take the form of a military incursion into Ukrainian territory on February 24, the Russian President Vladimir Putin had signed executive orders to recognize the Donetsk People's Republic and the Lunhansk People's Republic as independent countries

Talk of Sending Fighter Planes to Ukraine Is Madness

President Zelensky’s warmongering speech to the UK Parliament yesterday unequivocally and unashamedly made the case for starting World War 3 in order to polish the oversized ego of this little clown with the piano playing penis when he demanded that Nato-grade fighter jets to be sent to Ukraine.

Ukraine End Game: As Bakhmut Falls Real Reporting Vies With Propaganda In Western Media

Ever since Russia crossed the Ukrainian border and launched its 'Special Military Operation' almost a year ago now, everyday in western news media we have watched, heard and read that Ukraine was winning the war - Russia was losing ten soldiers for every Ukrainian casualty, Russian troops were incompetent brutes, Russian military hardware did not work and the Russians were running out of missiles, bullets and everything else.

In the wake of attacks on the on the Stream pipelines, that effectively halted the flow of natural gas which German industry, commerce, agriculture and society relies on, and the terrorist attack on the Kerch Bridge, US Secretary of State Antony Blinken gloated that the attacks were a “tremendous opportunity” to weaken Moscow [...] And shortly after news of the Nord Stream sabotage broke on mainstream media, gas supply companies in the USA were offering to supply Europe with shipments of Liquid Natural Gas carried by supertanker to be sold to European nations at vastly inflated prices.

Who Blew Up The Nordstream Pipeline

So whodunnit? Sabotage of undersea gas pipe will escalate tension and move the world closer to nuclear war, but who is behind it, Russia in a bid to put more presure on Europe, Ukraine in an attempt to drag NATO into direct action, or the USA using a CIA false flag event to advance its own agenda.

Russia Ukraine Dirty Bomb Claim - Some Reality

As the situation in Ukraine gets more desperate with casualty numberrs mounting, half the national infrastructure in ruins and Russia upping its game in response to US / NATO military assistance privided to the neo nazi nutters in Kiev, a false flag event seems the only way to provide an excuse for direct US intervention. And the USA has a track record for fgalse flag events ...

Who Blew Up The Nordstream Pipeline

So whodunnit? Sabotage of undersea gas pipe will escalate tension and move the world closer to nuclear war, but who is behind it, Russia in a bid to put more presure on Europe, Ukraine in an attempt to drag NATO into direct action, or the USA using a CIA false flag event to advance its own agenda.

An Energy Crisis In Tandem With A Food Crisis On Top Of An Economic Crisis And A War. This Cannot End Well

As politicians in North America and Europe try to deflect from their own failure that have contributed to the current plethora of crises by blaming Russia and Vladmir Putin for all the current problems, while the war in Ukraine is a contributory factor in each, the real blame lies closer to home.

Swedish Media Outlet Publishes Leaked U.S. Document On How to CRUSH Europe Economy via Ukraine War Effort

Swedish news organisation Nya Dagbladet has published a leaked top secret US plans to use the war in Ukraine and an induced energy crisis to destroy European economies.

The report claims the RAND Corporation a defence and foreign policy think tank founded by military aircraft maker Douglas has the official aim of improving policies and decision-making, is the source of its evidence.

Has Putin Has Pushed Europe Into Economic Depression, Hyperrinflation and Currency Collapse?

Though it was entirely predictable and indeed had been expected for some time, the news over the weekend that the Nord Stream 1 pipeline which feeds gas from Russia to northern Europe via The Baltic route had been shut down completely by The Kremlin in retaliation for the continued financial and military support given by NATO and EU member states to Ukraine in the conflict with Russia. The European Commission, governing body of the EU, immediately put the community on something close to a war footing, ...

Continue reading >>>

Is Russia Selling Its Oil To The World Through An Obscure Egyptian Port?

As this blog predicted when NATO and EU member states shot themselves in the foot by reacting to Russia's invasion of Ukraine with sanctions that prevented Russia from selling oil, gas and vital raw materials to the countries that needed them most, the NATO and EU member states, the Russians have had no problems finding alternative customers for their gas and oil and no problem getting oil into the world's commodity markets through the back door.

As the war in Ukraine grinds on and Russia steps up its economic war against the west and in particular The European Union, claims made recently by the idiotically 'woke' leaders of Europe's main economic and military powers that the West has a once-in-a–generation chance to severely weaken Russia’s capabilities, both militarily and geopolitically, look increasingly hollow. Putin's critics have cited 'Western unity' as one of the main reasons why Russia will be economically destroyed and politically humiliated when the Ukraine's military finally claim victory.